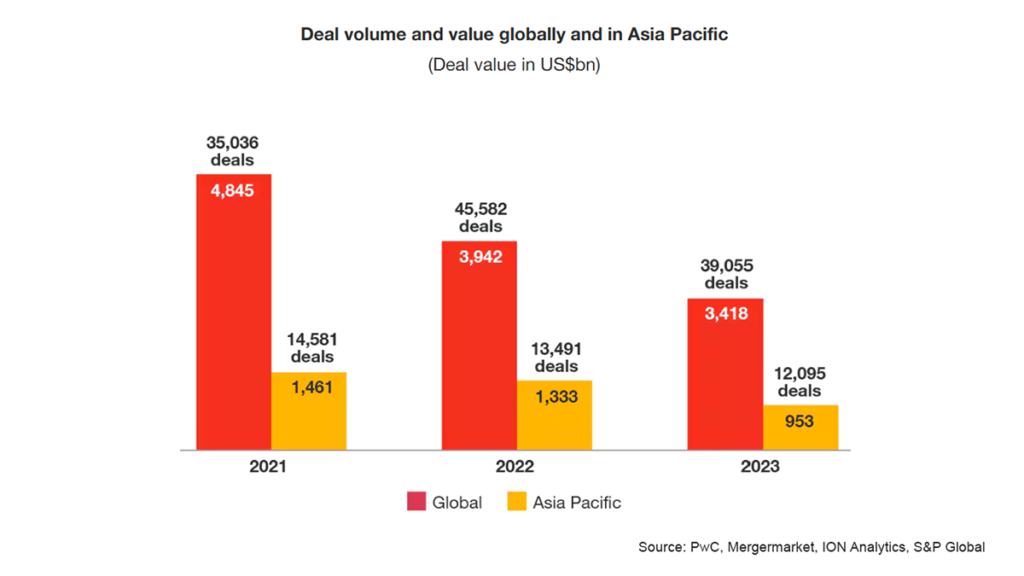

Asia stands as a dynamic epicenter of global economic activity, with its mergers and acquisitions (M&A) sector exhibiting robust growth. Valued at a significant volume in 2023, the M&A market in this region attracts a broad array of stakeholders, from multinational corporations to local enterprises, all seeking to capitalize on the strategic insights provided by expert Asia M&A consulting services. These services are crucial for navigating complex transactions and fostering informed decision-making amidst Asia’s vibrant economic landscape. In this article, we will take you through the vital trends and strategic movements shaping Asia’s M&A landscape.

Overview of Asia’s M&A Landscape in 2023

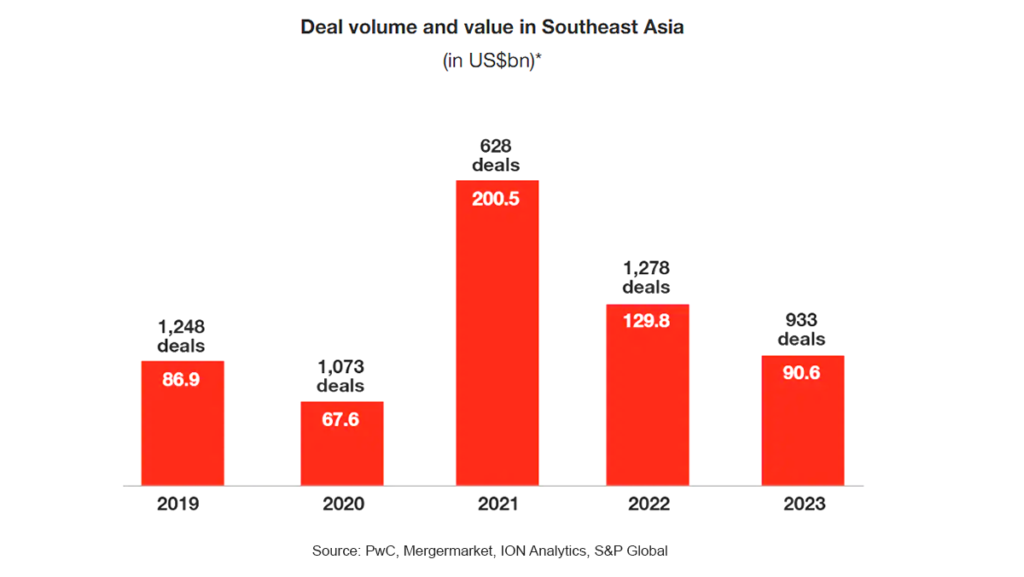

2023 marked a pivotal moment for mergers and acquisitions across Asia, demonstrating strategic agility as companies enhanced their portfolios through acquisitions and divestments. Despite early economic challenges, including high interest and inflation rates, the M&A landscape in Southeast Asia showed robust growth, highlighted by a record high in deal values during October, peaking at US$412 billion. However, the total number of global deals slightly dipped, reflecting a more selective and strategic approach.

Strategic Transactions and Growth Sectors

The year witnessed significant transformations, especially in the energy sector, underscored by the US$65.3 billion merger between Pioneer Resources and ExxonMobil Corp. Southeast Asia, despite fewer transactions, excelled, driven by high-value deals such as the US$23.1 billion acquisition of VinFast Auto by Black Spade Acquisition. This deal not only represents the largest in the region but also highlights the burgeoning industrial, automobile, and healthcare sectors.

Investment Dynamics and Sector Highlights

Despite a downturn in global private funding, which fell to its lowest in six years, Southeast Asia’s digital economy continues to attract substantial investments, especially in technology, renewable energy, and telecommunications. The technology sector alone announced over 200 deals, indicative of a strong trend towards digitalization. The financial services and consumer & retail sectors also saw significant activity, with reported deal values exceeding US$17 billion.

Regional Focus: Southeast Asia’s Dynamic M&A Activity

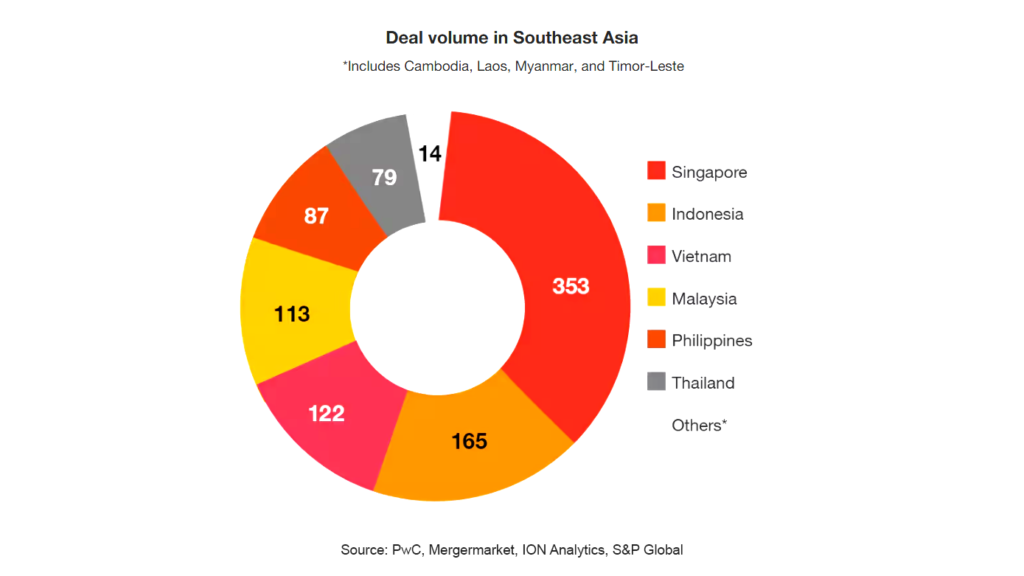

Southeast Asia surpassed pre-pandemic levels, achieving the highest average deal size in three years at approximately US$10.3 billion per deal. Countries like Singapore, Indonesia, and Vietnam, each participating in over 110 deals, underscored the region’s attractiveness to foreign investors. Strategic reforms, such as Vietnam’s Law on Investment and the Philippines’ Foreign Investment Act, have further boosted foreign interest.

Future Outlook and Opportunities in Asia’s M&A Landscape

Looking ahead, the M&A scene in Asia, particularly in Southeast Asia, is poised for continued growth and diversification. The digital transformation driving mergers and acquisitions promises to keep the region at the forefront of global M&A activities, focusing on enhancing operational efficiency and sustainability.

Conclusion

In conclusion, 2023 was a year that tested the strategic resolve of companies across Asia but also provided numerous growth opportunities through M&A activities. As businesses continue to navigate changing economic conditions, insights from seasoned Asia M&A consulting firms will be invaluable in steering future transactions towards profitability and sustained growth. The coming years are set to be dynamic as Asia cements its position as a global leader in M&A innovation and execution.