The landscape of mergers and acquisitions in Asia experienced significant shifts in 2023, setting a transformative stage for 2024. With an eye towards recovery and growth, the upcoming year promises a cautious yet opportunistic outlook for M&A activities across the region. Last year, the global M&A market size fell by 20% to around $3 trillion, influenced by high interest rates, geopolitical tensions, and stringent regulatory challenges. Notably, private equity funds saw a marked decrease in their participation in M&A activities, down by 57%, primarily due to adjustments in financial allocations amid changing economic conditions. Navigating such a complex landscape necessitates guidance from a talented team of M&A consulting in Asia. Here are some insights from our team:

Economic Shifts and Regional Impact in Asia

The downturn affected various regions differently within Asia. The EMEA region saw a significant contraction in M&A activity by 33%, heavily impacted by the Russo-Ukrainian war. Similarly, the APAC region, including key players like Australia and India, experienced a 28% decline. North America, in contrast, saw a relatively minor reduction of 6%. These shifts underscore the varying degrees of economic resilience and market reactions across the globe.

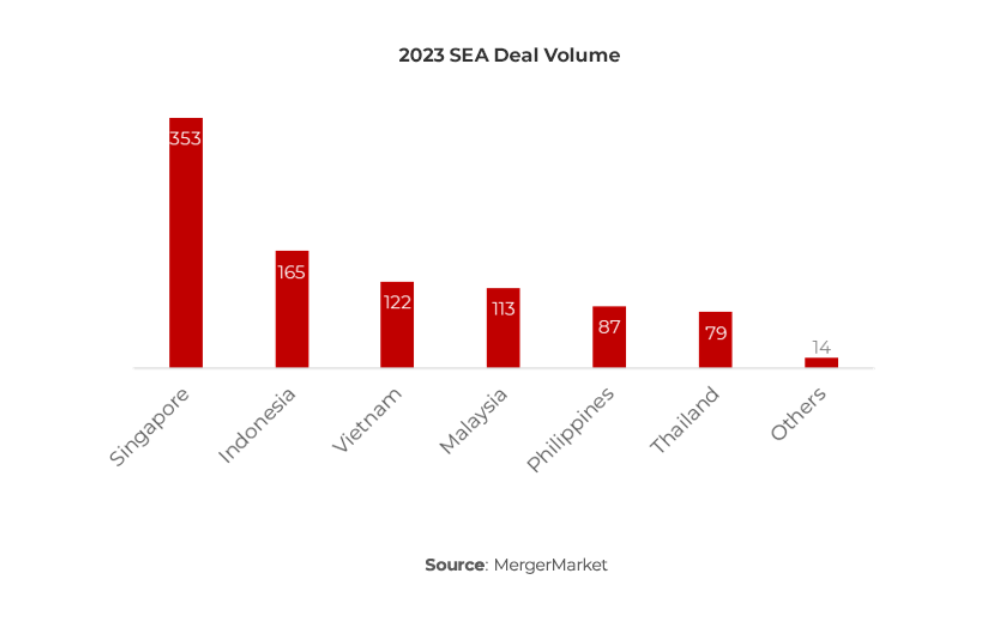

China’s economic hurdles in 2023, including US trade tensions and internal challenges like rising labor costs and sluggish recovery efforts, led to a 4.6% decrease in exports, impacting its M&A landscape. Conversely, Southeast Asia maintained a robust M&A scene relative to its peak in 2021, with countries like Singapore, Indonesia, and Vietnam leading in sectors such as technology and industrials.

M&A Trends in Key Asian Economies

Japan and Korea presented contrasting scenarios. Japan experienced an increase in M&A deal volume due to favorable financial conditions, such as persistently low interest rates. In Korea, however, M&A activities decreased by 22% due to new regulatory requirements and unfavorable exchange rates, affecting foreign investment appeal.

Anticipating Future M&A Trends in Asia

As 2024 approaches, the Asia M&A outlook 2024 is shaped by the potential for recovery in several key sectors. This expected resurgence is particularly evident in technology, healthcare, and green energy sectors, which are likely to drive M&A activities. Additionally, strategic shifts in consumer behaviors and accelerated digital transformation are set to influence deal-making strategies. The emphasis on sustainable and ESG-related investments is also predicted to boost M&A transactions, reflecting a deeper integration of corporate responsibility into business strategies.

The GCC region, with its robust economic indicators and strategic shifts towards economic diversification, is emerging as an increasingly attractive area for M&A. With large-scale international events and significant investments in infrastructure, the region is poised to leverage its economic stability to attract cross-border investments, particularly in sectors such as renewable energy, tourism, and technology. The GCC’s commitment to sustainable development and technology integration offers unique opportunities for strategic M&A engagements.

Looking ahead, Southeast Asia and Japan, along with the GCC, are poised to be particularly dynamic arenas for M&A activities, with emerging markets expected to play a critical role in the global M&A landscape. The easing of monetary policies and a more favorable economic environment are anticipated to facilitate greater cross-border collaborations and investments.

Eurogroup Consulting: Your Partner in Navigating M&A in Asia

At Eurogroup Consulting, with over 40 years of experience, we excel in guiding businesses through these dynamic shifts in the Asian M&A landscape. Our comprehensive advisory services are tailored to navigate the complexities of corporate finance, strategic investments, and regulatory compliance. Whether it’s facilitating joint ventures, managing due diligence processes, or ensuring legal alignments, we are dedicated to propelling your business towards successful mergers and acquisitions in Asia. As the M&A landscape evolves, partnering with experienced consultants in M&A Consulting in Asia like us ensures that you are well-prepared to seize opportunities and drive growth in the dynamic markets of Asia.