After a turbulent stretch marked by high-profile deal failures, Asia’s mergers and acquisitions (M&A) scene is showing signs of a strong comeback. The Asia M&A Deal-making Rebound is not just about rising numbers—it’s about renewed strategy, focus, and resilience.

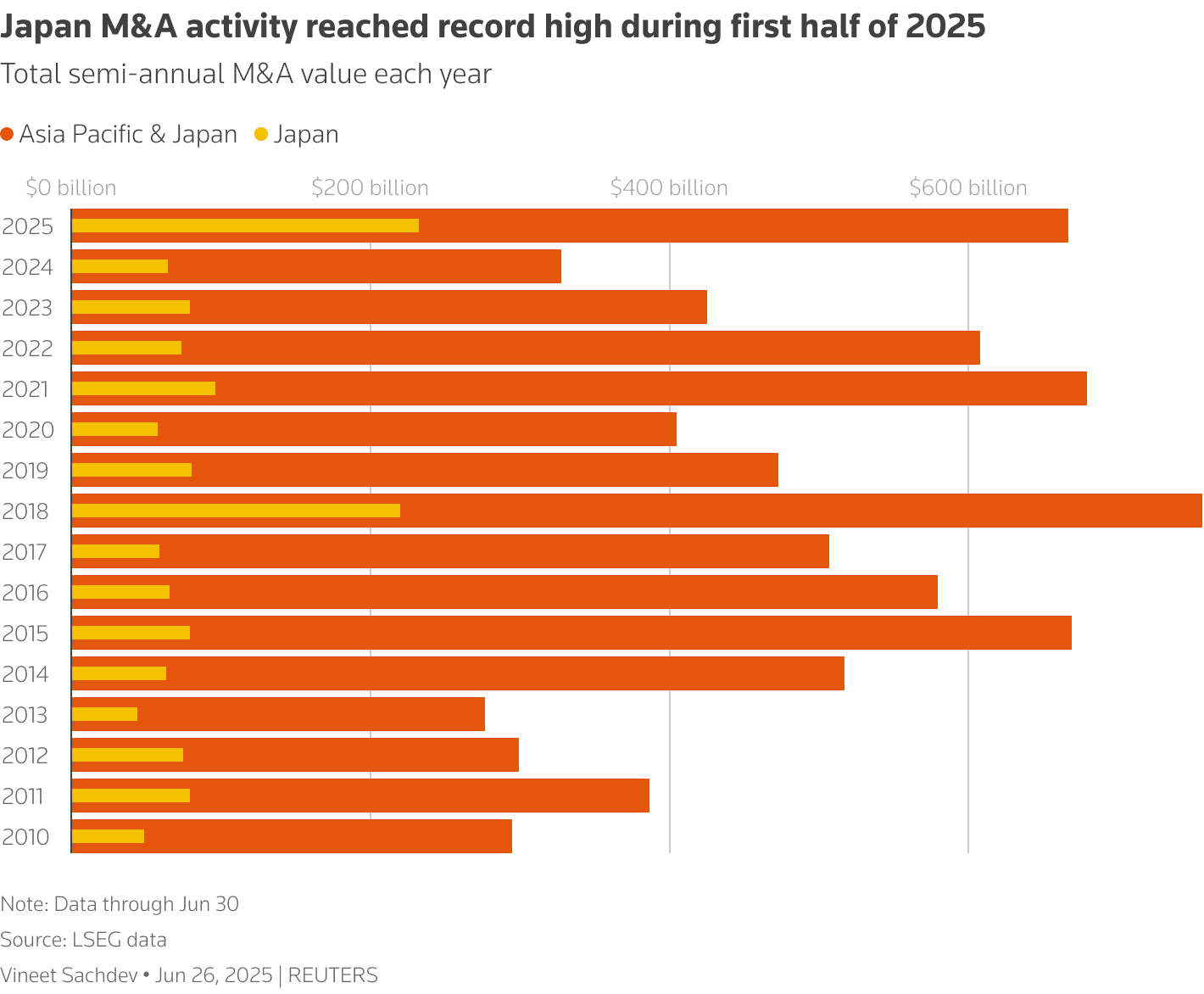

In the first half of 2025, Asia-Pacific’s M&A deal value surged to $572 billion, marking a 97% increase year-on-year. This happened even as deal volume slipped 6%, signaling a shift toward fewer but larger and more strategic deals. The surge reflects investors’ growing appetite for scale and long-term stability in a volatile global economy.

Japan Takes the Lead in Asia M&A Deal-Making Rebound with Record-Breaking Deals

At the heart of this rebound stands Japan. The country notched a record $232 billion in M&A deals in H1 2025, more than tripling its previous year’s total. Japan’s resurgence has single-handedly driven Asia’s overall M&A value to around $650 billion, underscoring its dominant role in the region’s revival.

Japanese firms, once conservative dealmakers, are now aggressively pursuing acquisitions to expand globally and strengthen domestic portfolios. This shift reflects confidence in corporate reforms and a favorable financing environment. Japan’s activity also sets a tone for others in the region—strategic boldness tempered with risk awareness.

Read Also: Asia Pacific M&A Resilience Shines in 2025 Deals

Southeast Asia Emerges as a Powerhouse

Beyond Japan, Southeast Asia has become an unexpected bright spot in the Asia M&A deal-making rebound. In the first quarter of 2025, M&A deal value in the region jumped 296.1% quarter-on-quarter, mainly fueled by Indonesia’s state-owned enterprise restructurings. The average deal size rose 22% compared to 2023, showing growing sophistication and investor confidence.

This boom highlights the region’s transformation from a secondary player to a vital hub of strategic deals. Companies and investors are finding value in localized growth opportunities, infrastructure partnerships, and cross-sector integrations.

Asia M&A Deal-Making Rebound: Regrouping After Setbacks

Despite the impressive rebound, Asia’s M&A landscape is not without its challenges. By the third quarter of 2025, total deal activity rose only about 1% year-on-year, signaling a more cautious phase. The slowdown reflects dealmakers’ attempts to regroup after several high-profile transaction failures earlier in the year.

These setbacks have forced many to reassess valuations, timelines, and risk tolerance. Economic uncertainty and shifting interest rate environments have made due diligence and deal structuring more complex. The mood among Asia’s dealmakers today is measured but not pessimistic—focused on stability and sustainable growth.

Shifting Focus: From Global to Local

One of the clearest signs of recalibration is the decline in cross-border M&A. In 2025, only 25% of Asia’s deal value came from cross-border transactions—down from 40% before the pandemic.

Geopolitical tension, stricter regulations, and supply chain realignments have pushed dealmakers toward domestic and intra-regional opportunities. Japan and India are leading this inward turn, with investors channeling capital into sectors like energy transition, technology, and financial services.

This pivot doesn’t signal retreat—it reflects strategy. Companies are focusing on markets they understand deeply, where regulatory frameworks are clearer and synergies are stronger.

Private Equity Steps In

While corporates are recalibrating, private equity (PE) has moved in fast. Buyout deal values more than doubled year-on-year in Q1 2025, signaling strong conviction among investors.

PE firms are betting on Asia’s long-term fundamentals—rising consumption, digital growth, and urban transformation. Even after recent failures, private equity’s aggressiveness suggests that confidence in Asia’s M&A potential remains strong.

Read Also: Asia M&A Private Equity Resilience Lifts Deal Values

Asia M&A Deal-Making Rebound Is a Rebound Built on Lessons

Asia’s dealmakers have learned from recent misses. The region’s rebound isn’t just about recovery; it’s about adaptation. Valuations have stabilized, regulatory navigation has matured, and risk management has improved.

If the first half of 2025 was about regaining momentum, the second half is about strategic precision. The Asia M&A deal-making rebound is now a story of resilience—driven by lessons learned, not just numbers achieved.