The infrastructure investment landscape is changing fast. Despite macroeconomic headwinds, global investor appetite for long-term, stable assets remains strong. In this environment, Asia Infrastructure M&A Fundraising is becoming a focal point, with Stonepeak recently closing a $4 billion fund dedicated to the region. The strategy reflects rising demand for digital infrastructure, logistics, and energy transition projects that are reshaping Asia’s economy.

Global Fundraising, Asia Infrastructure M&A Fundraising Remain Resilient

The global infrastructure fundraising market is expected to raise more than $140 billion in 2025. This figure highlights investors’ confidence in infrastructure as a reliable asset class, even as broader markets remain volatile.

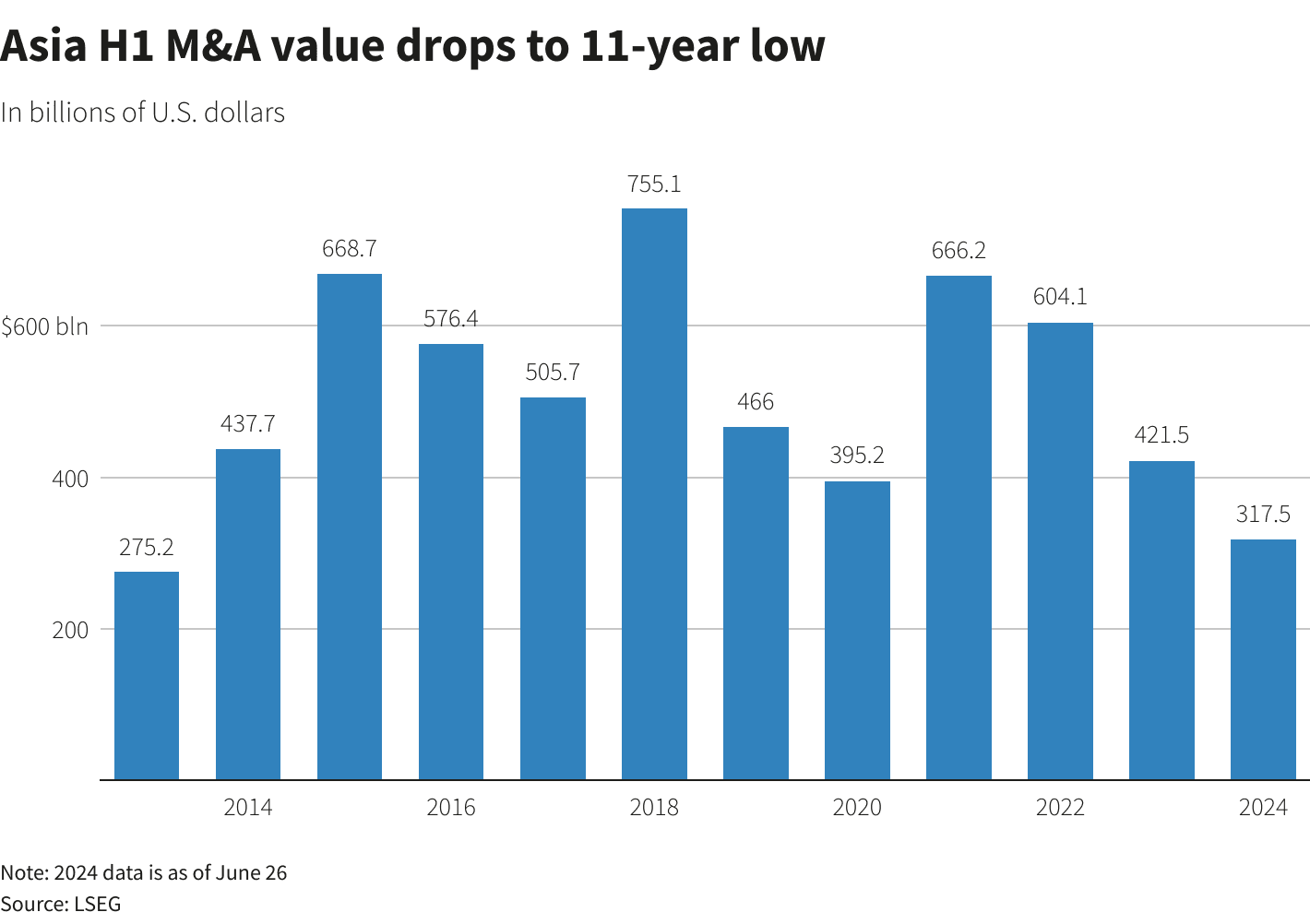

While Asia’s M&A deal counts fell 25% year-over-year in H1 2024, and average deal size dropped 14%, fundraising grew instead. Levels increased 14% year-over-year in 2024, signaling that institutional investors are taking a long view. The focus is shifting toward core and value-add strategies, targeting sectors that balance stability with growth potential.

Asia Emerges as a Growth Engine

Nowhere is this trend more visible than in Asia. The region’s buyout deal value surged from $26.8 billion in Q1 2024 to $57.6 billion in Q1 2025, or more than doubling in just a year. This rapid acceleration underscores both the scale of opportunity and the confidence investors have in Asia’s long-term infrastructure needs.

Institutional investors also hold a record $335 billion in dry powder, providing ample liquidity to fund new opportunities. Against this backdrop, Stonepeak’s $4 billion raise positions it well to capture growth across Asia’s expanding infrastructure sectors.

Read Also: See Why Investor Confidence Grows in Asia M&A Trends 2025

Asia Infrastructure M&A Fundraising: Stonepeak’s Investment Focus

Stonepeak’s latest fund is not just about scale; it is about strategy. The firm plans to deploy capital into three priority areas:

Data centers – supporting Asia’s digital economy with Tier IV standards and scalable energy-efficient facilities.

Logistics – investing in regional transport hubs, warehouses, and distribution networks as supply chains diversify.

Energy – targeting both conventional and renewable projects to meet rising demand while supporting energy transition goals.

These areas align closely with thematic drivers in global infrastructure. As demand for cloud computing, e-commerce, and clean energy accelerates, Stonepeak is positioning its portfolio where growth and resilience intersect.

Shift Toward Value-Add Infrastructure

A key trend shaping Asia Infrastructure M&A Fundraising is the movement away from purely core assets toward value-add and hybrid strategies. Investors are accepting slightly higher risks in exchange for stronger returns.

For Stonepeak, this means targeting assets like logistics hubs or renewable projects that require capital upgrades but deliver strong long-term cash flows. The firm’s approach fits within the larger industry shift, where core+ and value-add assets are now considered central to balanced infrastructure portfolios.

Why Asia Matters for Infrastructure M&A

Asia’s demographic scale, urbanization, and energy needs make it a natural hub for infrastructure investment. Countries across the region are upgrading power grids, expanding transport networks, and building out digital backbones.

Stonepeak’s $4 billion raise demonstrates not only confidence in Asia’s growth story but also the willingness of global capital to back long-term development themes. As consolidation continues in the infrastructure market, funds with targeted strategies and scale will likely dominate deal flows.

Asia Infrastructure M&A Fundraising: New Phase

While deal volumes dipped in 2024, global fundraising momentum continues to rise, signaling investor trust in the asset class. Asia, with its rapid growth and evolving infrastructure demands, is emerging as the centerpiece of this trend.

With its $4 billion fund, Stonepeak is set to play a leading role in shaping the future of data centers, logistics, and energy projects across the region. The firm’s strategy captures both the resilience of infrastructure as an asset and the dynamism of Asia’s economic transformation. For investors, the message is clear: Asia Infrastructure M&A Fundraising is not only robust but also central to unlocking the next wave of growth opportunities.