Asia is witnessing a powerful shift in deal-making. The surge in mergers and acquisitions (M&A) is being fueled by digital infrastructure needs, with companies racing to secure assets in data centers, cloud services, and artificial intelligence (AI). This wave of Asia M&A Cross-Border Digitization activity is reshaping the region’s investment landscape and turning Asia into a global hotspot for digital transformation.

Asia M&A Cross-Border Digitization: Explosive Growth in Cross-Border Deals

By the end of the first half of 2025, M&A transactions linked to Asia-Pacific’s digital transformation had already hit US$92.4 billion across 1,195 deals, a 113% year-on-year increase in value. By September 2025, the total had risen further to US$111.7 billion, already surpassing the 2024 comparable period of US$77.2 billion.

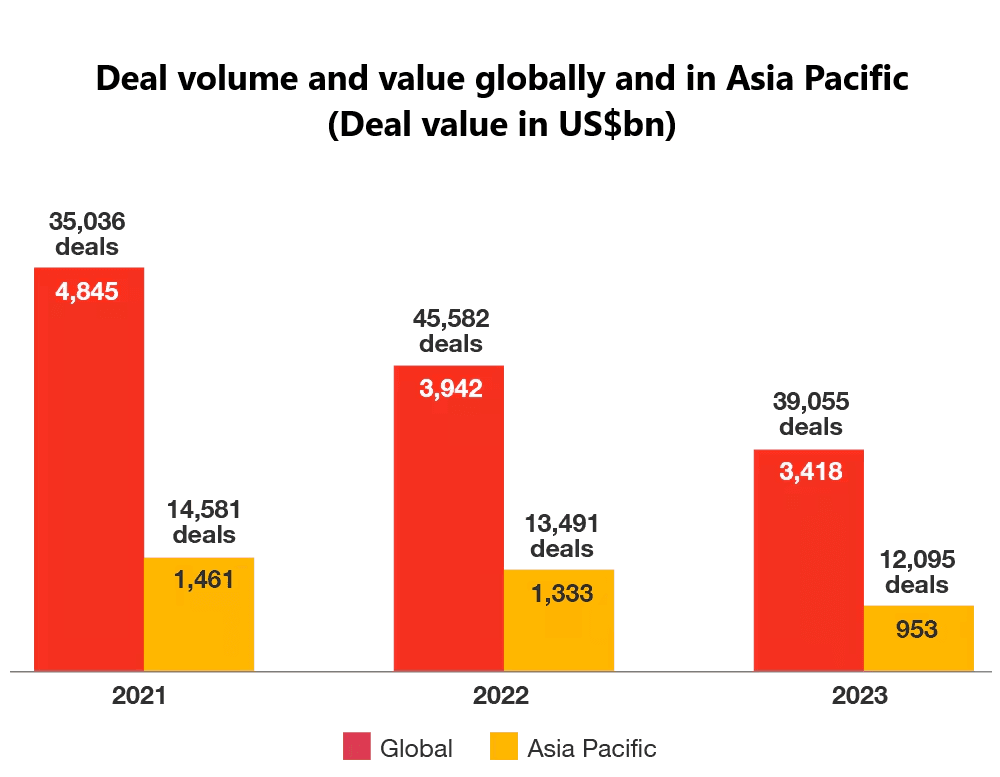

Cross-border activity is particularly strong. Even as global volumes fluctuated, cross-border mid-market deals rose by 2 percentage points in 2024. This shows resilience and highlights how digital infrastructure remains a priority investment theme.

Technology as the Prime Catalyst

Technology leads the charge. In global surveys, 71% of respondents listed technology among their top three sectors for M&A, underscoring its dominance. Demand for AI infrastructure, cloud capacity, and digital platforms is driving inbound cross-border M&A into Asia.

Read Also: Japan Leads Asia M&A $4T Market Forecast Momentum

Countries across Southeast Asia are benefiting. Malaysia, for example, attracted US$32 billion in digital sector investments within 10 months of 2024, tripling its 2023 total. Major hyperscalers such as Microsoft, AWS, and Google are behind much of this capital inflow.

Indonesia has also emerged as a leader. In Q1 2024 alone, it recorded US$4.8 billion in M&A activity, the highest deal value in ASEAN. Technology and data infrastructure were central to this growth, reflecting the nation’s rapid digital adoption.

Data Centers: The Heart of Asia M&A Cross-Border Digitization Transformation

Nowhere is this momentum more visible than in data centers. Asia Pacific’s total data center transaction value (M&A and investments) reached US$34.44 billion in 2024, close to a three-year high.

Capacity is expanding fast but still cannot keep pace. The region’s data center capacity is projected to double to around 30GW by 2027/2028, yet demand from AI workloads is set to outstrip supply by 15–25GW. This shortage is pushing firms to pursue aggressive M&A strategies to secure assets and meet future demand.

Local providers are also booming. PT DCI Indonesia, a leading player, reported a 118% revenue increase in Q1 2025 compared with Q1 2024, reflecting how surging demand translates directly into financial growth.

AI and Cloud Driving Mega Investments

AI and cloud services are driving record-breaking deals. Microsoft announced a US$2.2 billion investment plan in Malaysia for AI and cloud services over four years, with additional expansion planned in Thailand and Indonesia. These investments not only expand local data capacity but also cement Asia as a hub for global AI infrastructure.

Read Also: How Southeast Asia M&A Digital Transformation Fueled by New Tech

Balancing Opportunity with Challenges

While growth is strong, the market faces challenges. Higher interest rates, geopolitical tensions, and regulatory complexities can slow deal-making. Yet the digital infrastructure story remains too compelling to ignore. Companies view Asia as a long-term growth engine where scale, innovation, and demand converge.

Asia M&A Cross-Border Digitization: The Future Outlook

Asia M&A Cross-Border Digitization is accelerating at an unprecedented pace. The combination of soaring digital adoption, rising AI workloads, and massive investments in data centers ensures that momentum will continue well beyond 2025. With a supply gap looming and competition heating up, cross-border M&A will remain central to how Asia builds its digital future.