In the first half of 2025, Asia M&A Deal Value Growth in the Asia-Pacific region told a story of fewer deals but greater ambition. While the total number of deals fell by 8%, the total deal value climbed an impressive 14%. This contrast shows a clear shift in focus, that companies are chasing scale, not just activity.

Asia M&A Deal Value Growth Says “Bigger, Not More”

The decline in deal volume might sound negative at first. But the rise in value tells a different story. It suggests that investors and companies in the region are prioritizing high-impact deals. Fewer transactions are happening, but each one carries more weight. This is a signal of confidence and strategic thinking rather than hesitation.

The 14% rise in deal value means companies are pursuing mergers and acquisitions that bring greater long-term growth potential. These are not just quick wins or market grabs. They are carefully planned moves aimed at strengthening regional and global positions.

Read Also: After Misses, Asia M&A Deal-Making Rebound Finds Its Footing

Asia-Pacific’s Role in the Global M&A Landscape

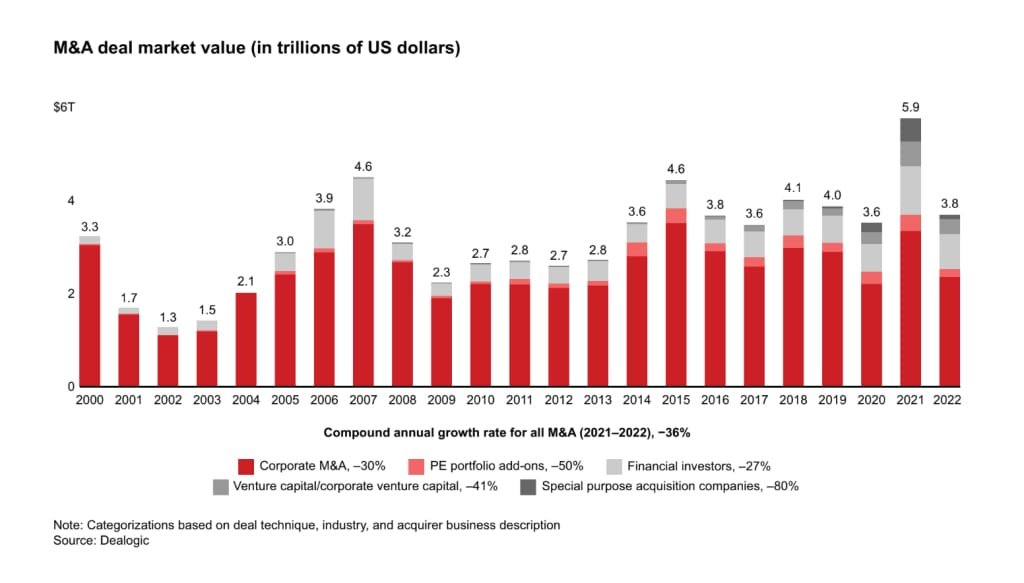

Globally, M&A volume has been under pressure, with many markets seeing slower activity. Yet, the Asia-Pacific region stands out. Even as deal numbers fell, Asia M&A Deal Value Growth in the region maintained strong momentum in deal value. This shows that Asia-Pacific remains a vital force in global M&A, proving that quality transactions can thrive even when market conditions are mixed.

The Americas still led globally with around $908 billion in total deal value during the first half of 2025. But what’s striking is how Asia-Pacific buyers doubled their investment into the Americas during the same period. Their cross-regional investments jumped from 11% to 22% of total deal value. This isn’t just a sign of confidence — it’s a statement of intent. Asia-Pacific investors are looking outward, not just inward, and are securing a stronger global footprint.

Strategic Shift Toward Larger, High-Value Deals

The market behavior seen in early 2025 highlights a clear pattern: Asia-Pacific investors are making fewer but larger, more strategic deals. This signals maturity and sophistication in how companies across the region approach mergers and acquisitions.

Such a trend often points to a more selective and calculated approach. Rather than expanding for the sake of growth, organizations are targeting specific assets that bring technology, talent, or market advantages. In this sense, the drop in volume is not a weakness — it’s a refinement of strategy.

Read Also: Asia M&A Optimism 2025 Amid Easing Rate Pressures

The Bigger Picture of Asia M&A Deal Value Growth

The Asia-Pacific region’s strong 14% growth in deal values amid an 8% decline in deal volumes demonstrates resilience and adaptability. It reflects a business environment that’s learning to balance risk with opportunity. Even as global uncertainty continues, Asia-Pacific’s dealmakers are focusing on transactions that can reshape industries and create long-term value.

This dynamic approach also indicates that regional players are thinking beyond borders. The doubling of investments into the Americas shows growing confidence in expanding influence and partnerships beyond Asia. It’s a trend worth watching as global markets continue to evolve through 2025 and beyond.

Asia M&A Deal Value Growth: Looking Ahead

As we move further into 2025, the Asia-Pacific region is likely to remain a major driver of global M&A activity. The combination of strong deal values, strategic cross-border expansion, and selective investment choices positions it as a powerhouse of growth and innovation.

Expert guidance can make a difference for companies seeking to understand or participate in this trend. To learn more about Asia M&A Deal Value Growth or explore how your business can benefit from these market shifts, contact Eurogroup Consulting M&A Asia, a global consulting firm with deep experience in strategy and M&A advisory.