The momentum for mergers and acquisitions (M&A) in Asia is building fast, and two sectors stand firmly in the spotlight: energy and technology. Across the region, the dealmakers of Asia M&A in Energy & Tech are betting big on renewable energy projects and digital infrastructure, as both areas become key engines of long-term growth.

Energy Transition M&A Hits Global Highs

In 2024, energy transition M&A worldwide reached USD 497 billion, or 13.4% of the total USD 3.7 trillion in global M&A activity. This shows how energy transformation has become central to global investment strategies.

Asia plays a vital role in this shift. The region’s push toward renewables, efficient power systems, and digital modernization has made it one of the world’s most active M&A markets.

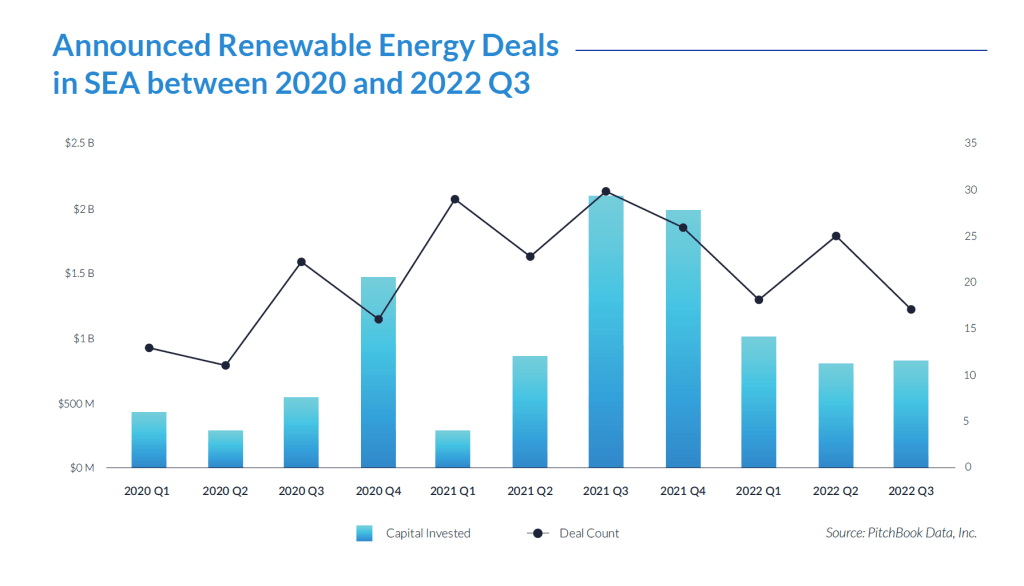

Southeast Asia Leads the Asia M&A in Energy & Tech Charge

Across Southeast Asia, governments are setting bold targets and removing old barriers to attract investment. Cambodia, for instance, aims to generate 70% of its electricity from renewable sources by 2030. In the Philippines, new rules now allow 100% foreign ownership in renewable energy projects. This is a game-changer for foreign investors seeking stable returns and local partnerships.

Read Also: Renewables and Asia M&A Technology Focus Lead H2

These policy changes are turning the region into a hotspot for energy transition deals. They also reflect how energy and tech investment now go hand in hand. From renewable power generation, needing digital systems, data analytics, and smart grids to function efficiently.

Big Deals Signal Growing Confidence in Asia M&A in Energy & Tech

The momentum is visible in the numbers. In Q1 2025, Asia-Pacific M&A deal value jumped 44%, reaching USD 113.8 billion across 2,416 deals. A major contributor was Xinneng Energy’s USD 10.1 billion acquisition of ENN Energy Holdings in China — one of the largest transactions in the energy space this year.

Experts expect more deals like this to follow. Initially, smaller and more agile groups are expected to lead the way in both energy and tech sectors. Later, multinational corporations are likely to step in, acquiring these companies once regulatory frameworks become clearer and market confidence grows through 2025.

Digital Infrastructure Powers the Next Wave

Asia’s M&A surge is not only about renewable power. Digital infrastructure, including data centers, commercial buildings, and energy-efficient technologies, is also driving record deal activity. As businesses and consumers demand faster digital services and more reliable power, investors are racing to fund the systems that support both.

By Q2 2025, the Asia-Pacific region recorded USD 186.8 billion in announced M&A deals across 2,325 transactions, showing that momentum remains strong. The leading countries are China, Japan, Australia, and India, all of which are focusing heavily on renewable energy integration and advanced digital systems.

Read Also: Asia Infrastructure M&A Fundraising Surges with $4B

Policy, Technology, and Capital Converge

The mix of progressive policy, rapid tech adoption, and strong investor appetite is reshaping Asia’s business landscape. As governments strengthen sustainability goals and companies digitalize operations, energy and tech are becoming inseparable — forming the twin pillars of Asia’s M&A future.

For investors, the message is clear: these sectors are no longer niche opportunities but central to the region’s economic strategy.

The Outlook for Asia M&A in Energy & Tech in 2025 and Beyond

With global energy transition investments already approaching half a trillion dollars, and Asia’s quarterly M&A volumes rising sharply, the Asia M&A in Energy & Tech story is only just beginning.

The coming year will likely see deeper cross-border collaboration, more renewable infrastructure development, and continued digital expansion. For dealmakers, this means a window of opportunity to capture long-term value in markets driven by innovation and sustainability.

If you want to understand where to invest or how to structure successful deals in Asia’s fast-moving energy and tech sectors, contact Eurogroup Consulting M&A Asia. As a global consulting firm with experience across markets and industries, they can help you explore tailored strategies and insights for the Asia M&A in Energy & Tech landscape.