After two years of tight financing and cautious investors, Asia’s mergers and acquisitions (M&A) market is showing signs of strong recovery. As inflation cools and borrowing costs ease, confidence is returning. The result: renewed Asia M&A Optimism 2025 across key markets and sectors.

In the final months of 2024, deal-making in Asia began to rebound. That momentum is set to continue through 2025. For investors and corporations that paused their expansion plans during high-rate cycles, the environment now looks far more inviting. Lower financing costs mean more room for strategic acquisitions, partnerships, and consolidation.

Asia M&A Optimism 2025: Inflation Eases, Financing Opens Up

High inflation weakens buying power, while rising rates make deal financing harder. That combination weighed heavily on Asia’s M&A activity during 2023 and much of 2024. Now, as inflation pressures ease and central banks cut interest rates, barriers to deal-making are falling.

Asian central banks followed the global shift in 2024 by reducing policy rates in response to easing inflation. This trend is expected to carry over into 2025, making it cheaper to borrow and finance acquisitions. With liquidity improving, the region’s dealmakers are preparing for a more active year ahead.

India Leads Regional Growth

Among Asian economies, India stands out as a leading performer. Its M&A growth is being driven by a combination of consumer market consolidation and rising international investor interest. Global companies continue to see India as a long-term growth engine, particularly in retail, technology, and financial services.

Strong domestic demand and regulatory stability have also played a key role. Local firms are seizing the opportunity to expand, while foreign investors view India as a reliable entry point into broader Asia-Pacific markets. These trends reinforce the country’s position as one of the main engines behind the region’s M&A revival.

Read Also: After Misses, Asia M&A Deal-Making Rebound Finds Its Footing

Reforms and Stimulus Boost Confidence

Elsewhere in the region, fiscal stimulus and structural reforms are beginning to bear fruit. In China, policy adjustments and pro-growth measures are helping restore investor confidence. Japan’s corporate reforms are improving governance and unlocking shareholder value, encouraging both domestic and inbound acquisitions. Australia, too, is benefiting from policy clarity and infrastructure investment, which are attracting both regional and global investors.

While M&A activity in Asia-Pacific was still sluggish in the early months of 2025 compared with North America and Europe, analysts expect a clear pickup in the second half of the year as these reforms take hold.

Technology and Cross-Border Ties Dominate Asia M&A Optimism 2025

Technology remains the region’s most active sector for M&A. Cross-border partnerships and digital transformation strategies continue to drive demand. Companies are looking to acquire new capabilities in data, cybersecurity, and AI to stay competitive.

This wave of digital consolidation is deepening connections across Asian markets. From Singapore’s fintech hubs to Korea’s advanced manufacturing and India’s digital platforms, deal activity in the tech space is expected to remain strong through 2025.

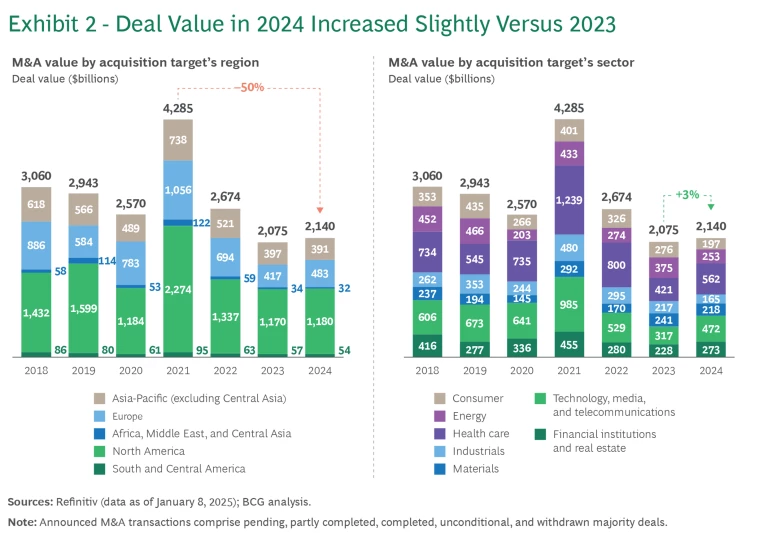

Deal Values Rise Despite Slower Volumes

Even as overall global deal volumes dipped in early 2025 compared to 2024, total deal values rose by 15%. This suggests growing Asia M&A Optimism 2025 and larger average deal sizes. In Asia, where financing is now more accessible and inflation less of a threat, investors are focusing on quality transactions rather than sheer volume.

Read Also: Asia Pacific M&A Resilience Shines in 2025 Deals

This shift from survival to strategy signals a maturing regional market—one that balances short-term caution with long-term opportunity.

Asia M&A Optimism 2025: A Year of Strategic Momentum

Looking ahead, economic fundamentals such as pent-up demand, lower rates, and stronger balance sheets support expectations of a robust rebound. Financial and consumer sectors are expected to benefit most as investors seek stable returns in an improving macroeconomic environment.

With inflation easing and borrowing costs lower, Asia is entering a more favorable phase for deal-making. As confidence rebuilds, Asia M&A Optimism 2025 is likely to stay strong throughout the year. For companies exploring expansion, restructuring, or acquisition opportunities, now is the time to act strategically. To navigate this evolving market and identify high-value opportunities, contact Eurogroup Consulting M&A Asia, a global consulting firm with deep expertise in M&A advisory and market entry strategy.