The Asia M&A Private Equity Resilience is becoming a defining theme across the region. Despite global headwinds, deal activity in 2024 and 2025 shows surprising strength. Investors continue to back high-value sectors, proving that Asia remains a hotspot for private equity.

Asia M&A Private Equity Resilience: Strong Momentum Despite Challenges

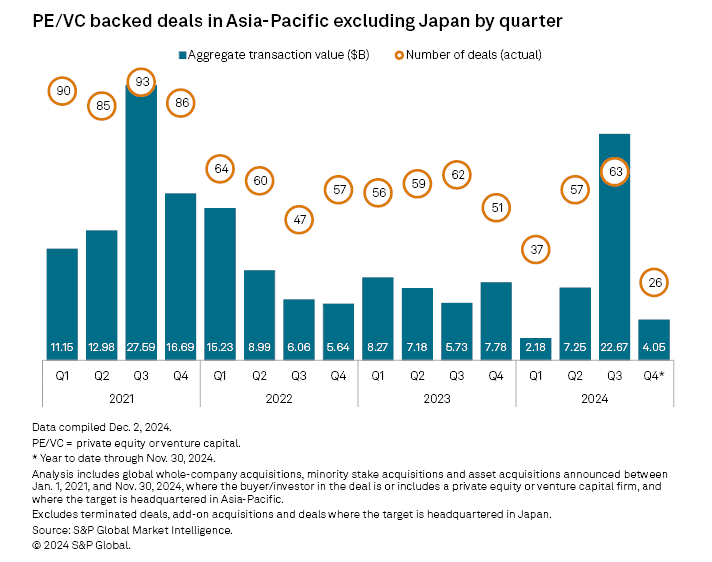

In 2024, Asia Pacific private equity (PE) buyout investments hit US$138 billion, an 8.1% increase from 2023. This was the second-best year for PE deals in the past decade. The rise came even as global markets struggled with inflation, shifting geopolitics, and uneven recovery. The performance underscores how Asia’s dynamic markets provide resilience in uncertain times.

Deal momentum carried into 2025. Asia-Pacific M&A deal value surged nearly 90% in the first half of the year, led by large-scale transactions. Japan, in particular, stood out with record activity, supported by governance reforms and favorable financing options.

Read Also: Asia-Pacific M&A Market Analysis and What Investors Must Know

Rising M&A Activity Across the Region

Asia-Pacific’s overall deal value increased 11% in 2024, with entry valuations rising in nearly every country except China. This signals widespread confidence among investors, especially in Southeast Asia, which has become one of the most active sub-regions.

In Q1 2025, private equity deals accounted for 20% of total M&A deal value across Southeast Asia. The total surged 5.5 times year-on-year, driven largely by the energy sector, which alone contributed 49% of deal value.

Sectoral Shifts Driving Asia M&A Private Equity Resilience

Energy investments dominated in early 2025, but other sectors also saw strong deal flows. In Q2 2025, financial services made up 29% of private equity deals, while technology contributed 28%. These figures reflect how investors are balancing traditional energy opportunities with growth in digital services and fintech.

Read Also: How Southeast Asia M&A Digital Transformation Fueled by New Tech

Singapore and Vietnam led the way in deal volume and value. Their regulatory stability, growing economies, and strong startup ecosystems are making them attractive hubs for PE activity. Even with fewer mega-deals, the breadth of mid-sized transactions highlights the adaptability of investors.

Why Asia M&A Private Equity Resilience Stays Strong

Several factors explain the strength of Asia M&A Private Equity Resilience:

Sectoral diversity: From energy to fintech, investors spread risk across industries with growth potential.

Reform momentum: Governance reforms in Japan and regulatory changes in Southeast Asia provide favorable environments.

Capital availability: Despite global tightening, Asia still attracts steady FDI inflows and fund commitments.

Regional optimism: Investor surveys highlight continued confidence in Asia’s long-term economic story.

Together, these dynamics create an ecosystem where private equity thrives even under pressure.

The Outlook Ahead

Energy will likely continue to dominate near-term deals, but financial services, healthcare, and technology are expected to attract rising interest. If mid-sized deal momentum continues, Asia Pacific may see not just resilience but renewed acceleration in private equity deal activity.

The story of Asia M&A Private Equity Resilience is far from over. With buyout investments already nearing historic highs, the coming years will test how adaptable private equity firms can be to ongoing global volatility. Still, the evidence so far suggests that Asia will remain central to global dealmaking.

FAQs

1. What drove the growth of private equity in Asia in 2024?

PE buyout investments rose 8.1% to US$138 billion, led by energy and high-value M&A deals.

2. Which sectors dominate Asia-Pacific private equity in 2025?

Energy accounts for the largest share, but financial services and technology are also growing rapidly.

3. How significant is Southeast Asia in private equity deals?

Southeast Asia saw PE deals make up 20% of total M&A deal value in Q1 2025, with Singapore and Vietnam leading activity.

4. Why is Japan seeing record M&A activity?

Governance reforms and easier financing options have fueled strong private equity interest in Japan.

5. What is the outlook for Asia-Pacific private equity?

Continued resilience is expected, with energy, fintech, and healthcare driving future deal growth.