The mergers and acquisitions (M&A) landscape in Asia-Pacific is showing an unusual but powerful trend. In the first half of 2025, deal values rose even as deal numbers declined. This shift in Asia-Pacific M&A Value Growth highlights the growing role of megadeals and the resilience of select industries across the region.

A Strong Start with Rising Values

Asia-Pacific M&A deal value almost doubled year-on-year, surging 97% to $572 billion in H1 2025. This figure reflects a market leaning toward fewer but larger and more strategic transactions. Large capital injections into Chinese banks and the unwinding of Japanese cross-shareholdings were among the top drivers of this growth.

In Q1 2025, the region recorded $113.8 billion across 2,416 deals, a 44% increase in value and 12% increase in deal count compared to Q1 2024. While activity slowed slightly in the second quarter, the momentum was strong enough to lift the half-year totals.

Asia-Pacific M&A Value Growth Halts, but Value Climbs

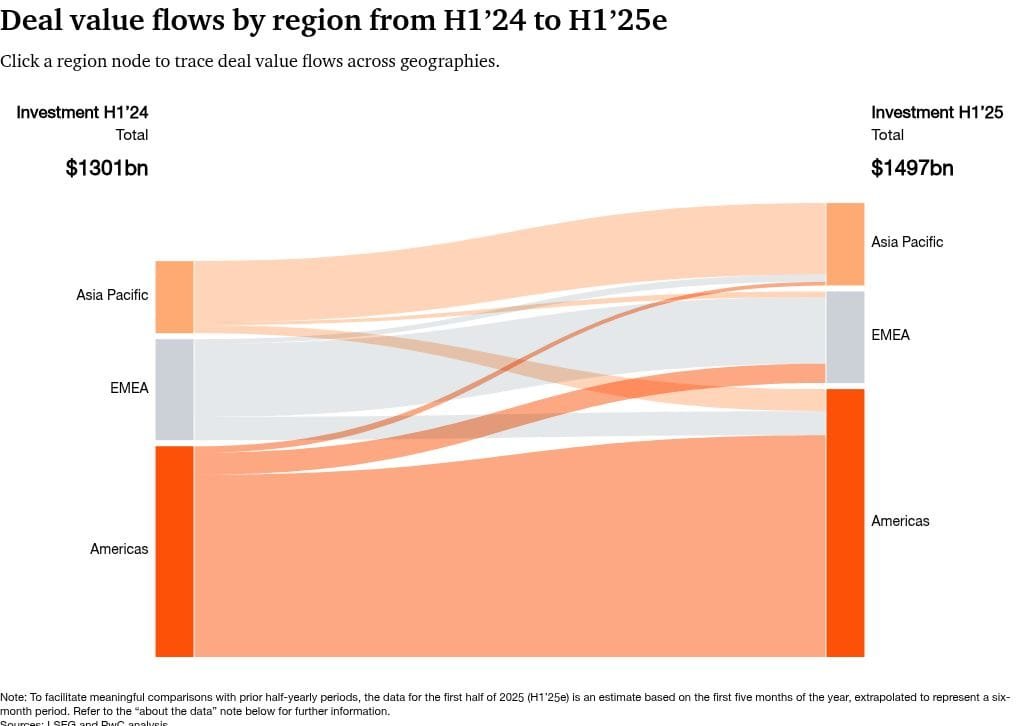

Despite the strong value growth, deal activity in terms of volume slowed. H1 2025 saw an 8% decline in deal numbers, even as overall deal value rose by 14% compared to the same period in 2024.

This reflects a broader global trend. Corporates and investors are prioritizing quality over quantity, targeting large, high-impact deals rather than pursuing numerous smaller ones. Globally, the number of deals worth over $1 billion increased, with 82 megadeals completed in H1 2025 compared to 69 last year.

Japan as a Growth Engine

Japan stood out as one of the most significant contributors to Asia-Pacific M&A value growth. The country posted a 175% jump in deal value, even though deal volume fell by 13%.

Two megadeals involving Toyota affiliates were the primary catalysts. These transactions highlight how large corporate restructurings and strategic realignments are reshaping the Japanese M&A market.

Read Also: Japan Leads Asia M&A $4T Market Forecast Momentum

India’s Mid-Market Story

India provided a contrasting picture. The country saw deal volumes climb 18%, reflecting healthy market activity and appetite. However, most of these were mid-market transactions, which limited overall deal value growth.

This underscores how regional dynamics vary within Asia-Pacific. While Japan is driving megadeals, India is experiencing a surge in smaller deals that broaden participation but do not boost headline numbers.

Read Also: The Asia M&A Private Equity Momentum You Can’t Ignore

Resilient and Challenged Sectors

Sector performance in H1 2025 was mixed. Aerospace and defense, chemicals, asset and wealth management, and power and utilities saw both volume and value gains. These industries appear resilient, supported by demand for innovation, security, and energy solutions.

On the other hand, retail, consumer, pharma, automotive, and industrials recorded declines. These sectors continue to face cost pressures, regulatory challenges, and weaker consumer sentiment, which limited their deal activity.

The Bigger Picture for Asia-Pacific M&A Value Growth

The Asia-Pacific M&A market reflects resilience amid uncertainty. Despite fewer transactions, the focus on larger, more strategic deals propelled deal values upward. This aligns with global patterns, where investors favor scale and transformative potential over smaller, riskier moves.

With $572 billion in deal value in just half a year, Asia-Pacific M&A Value Growth continues to play a crucial role globally. The combination of megadeals in Japan, steady momentum in India, and resilient sector performance suggests that deal-making will remain a key lever for corporate growth in the region.

FAQs

1. What drove Asia-Pacific M&A value growth in H1 2025?

Megadeals in Japan, capital injections in Chinese banks, and resilient sectors like aerospace and utilities fueled growth.

2. Why did deal values rise while volumes fell?

Fewer deals were made, but larger transactions pushed up total deal values.

3. Which country led M&A growth?

Japan stood out with a 175% surge in deal values despite lower volumes.

4. Which sectors performed best?

Aerospace, chemicals, asset management, and utilities recorded growth in both deal volume and value.

5. What does this mean for global M&A trends?

Asia-Pacific aligns with global trends, where megadeals are rising while smaller deals decline.