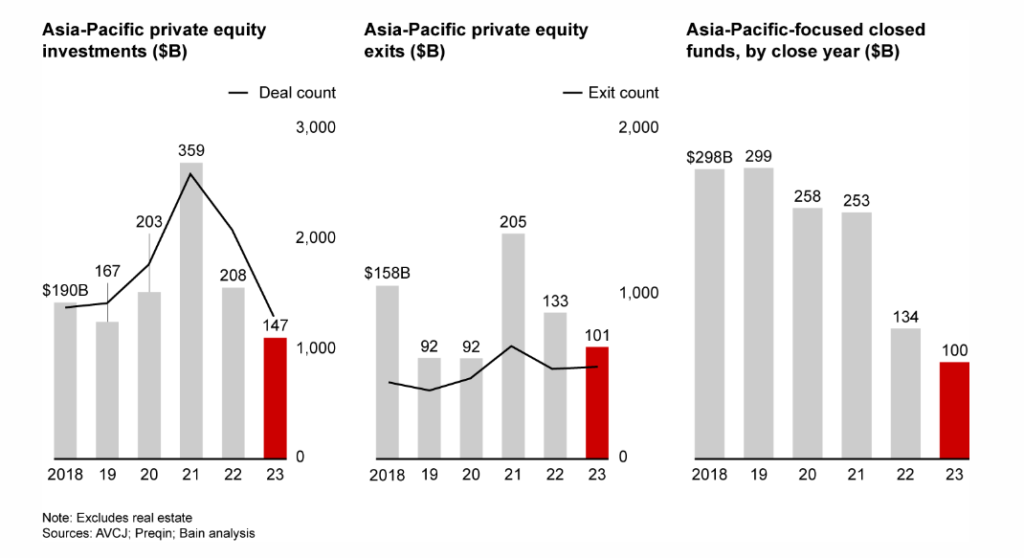

The Asia-Pacific private equity (PE) landscape faced significant headwinds in 2023, marking a challenging period for investors. Deal activity plummeted as economic uncertainties, high interest rates, and geopolitical tensions caused many to adopt a cautious stance. According to Bain’s Asia-Pacific Private Equity Report 2024, deal value dropped to $147 billion, and fundraising hit its lowest point in a decade at $100 billion.

A Challenging Environment for Private Equity

The decline in deal activity was not unexpected, given the myriad macroeconomic challenges. Investors were particularly wary of markets in Greater China due to its murky economic outlook, leading to a significant reduction in both deals and exits. Interestingly, Japan bucked the trend with a notable rise in deal activity, thanks to its stable regulatory environment, low interest rates, and a deep pool of target companies ripe for performance improvement.

Technology remained the dominant sector for deals and exits, but the energy and natural resources sector saw the only growth in deal value and volume. This shift indicates a growing investor interest in assets related to the energy transition, highlighting the sector’s potential for future investment opportunities.

The Shift Towards Alternative Assets

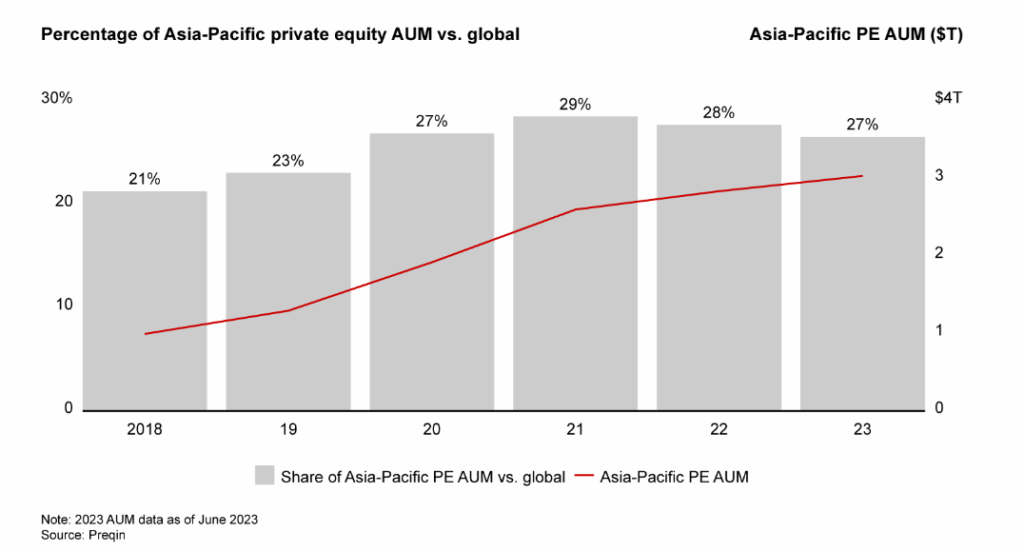

Given the tough market conditions, general partners (GPs) developed new strategies to find buyers and improve exit value. One significant trend was the exploration of alternative asset classes such as infrastructure and private credit, which offer growth opportunities in the Asia-Pacific region. This diversification helps mitigate risk and leverage growth potential in less volatile sectors.

Private credit and infrastructure funds have seen substantial growth, with private credit growing at an annual rate of 24% over the past five years. Infrastructure investments have also been buoyed by government initiatives and a global push towards sustainability and energy transition.

Market Insights and Future Outlook

Despite the challenging environment, there were signs of market improvement by the end of 2023. Inflation rates began to decline, interest rates in most Asia-Pacific markets are forecasted to decrease by late 2024 or 2025, and some currencies started to recover. Additionally, stocks showed strong performance in most markets, barring China and Southeast Asia.

Looking ahead, the Asia-Pacific PE market holds promise in several sectors. Disruptive innovations like generative AI are creating fresh opportunities. Many GPs are already scouting for generative AI assets and utilizing the technology to enhance operations and performance of portfolio companies. Japan, India, and Southeast Asia are highlighted as promising markets for PE investments, according to Preqin’s 2023 investor survey.

Strategies for Success

To succeed in this volatile market, GPs are increasingly focusing on portfolio management and exit planning. Effective pre-sales strategies and compelling equity stories for portfolio companies have proven crucial in attracting buyers and securing successful exits. Furthermore, identifying strategic fits and highlighting growth opportunities can significantly boost the chances of achieving target returns.

The path forward for Asia-Pacific private equity involves navigating through uncertainties with a keen eye on emerging sectors and strategic diversification into alternative asset classes. By leveraging their strengths and adapting to market conditions, PE funds can continue to thrive and deliver attractive returns to their investors.

In summary, the Asia-Pacific Private Equity Report 2024 highlights the importance of strategic adaptation and diversification. By focusing on emerging opportunities and effective portfolio management, the report offers valuable insights for navigating the challenges and maximizing returns in the Asia-Pacific PE market.