Private equity is proving to be a steady force in Asia’s mergers and acquisitions (M&A) scene. Despite global uncertainty and slower economic growth, Asia M&A Private Equity Momentum shows that the region’s private equity players are not backing down. In fact, they’re stepping up, and the numbers are talking.

Asia M&A Private Equity Momentum: Deal Values Surge

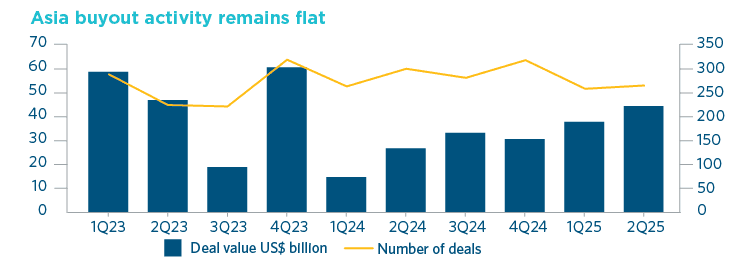

In the first quarter of 2025, Asia’s buyout deal value more than doubled year-on-year, rising from US$26.8 billion in Q1 2024 to US$57.6 billion. That’s not a small recovery. It’s a clear sign of strong Asia M&A Private Equity Momentum.

For all of 2024, the region recorded US$175.8 billion in buyout deals, the highest since 2021. This marked a 19% increase from US$141.8 billion in 2023, fueled by landmark transactions across multiple sectors.

Southeast Asia was a standout performer. In Q1 2025, private equity deal value there jumped 5.5 times year-on-year, with PE deals making up 20% of all M&A deal value across the region. That means one in five deals involved private equity.

Read Also: Asia M&A Optimism 2025 Amid Easing Rate Pressures

Strategic Investments Reflect Confidence

Large-ticket transactions underline how private equity firms are seeing long-term potential in Asia. In 2025, deals included an US$8.3 billion acquisition of a shopping mall unit in China and a US$7.1 billion privatization of a warehouse operator. These headline deals show that investors are still chasing quality assets, even in a complex macro environment.

In Q2 2025, Southeast Asia continued to show resilience in Asia M&A Private Equity Momentum. Deal volume rose 10% year-on-year, even though total deal value dipped due to fewer mega deals.

Sector data reveals where the smart money is going. In the same quarter, financial services (29%), technology (28%), and healthcare (27%) attracted the majority of private equity investment. This focus reflects a shift toward stable, growth-oriented sectors with long-term upside.

Tech and Infrastructure Lead Asia M&A Private Equity Momentum

Private equity investors are also targeting Asia’s expanding digital and energy infrastructure. The technology sector continues to attract strong attention, with data centers and AI-related assets in high demand.

A major example is Blackstone’s US$16 billion acquisition of AirTrunk data centers, signaling confidence in the region’s digital backbone. These types of deals highlight how infrastructure is now viewed as a critical growth engine, not just a support system.

Meanwhile, the energy sector accounted for 49% of deal value in Southeast Asia in early 2025. The focus here is on renewable energy and infrastructure projects, which align with both regional development plans and the global shift toward sustainability.

Read Also: Asia M&A in Energy & Tech Sparks Investor Rush in 2025

Across markets like Japan, South Korea, and India, private equity firms are securing stakes in technology-driven businesses. These moves show strategic discipline, where investors are balancing opportunity with resilience, building exposure in industries positioned for long-term relevance.

Resilience Amid Headwinds

Macroeconomic headwinds persist, such as inflation and slower growth, but Asia’s private equity landscape continues to adapt. The combination of sector focus, capital availability, and strong fundamentals is fueling ongoing Asia M&A Private Equity Momentum.

This steady momentum underscores the region’s unique position: while other markets hesitate, Asia continues to move forward through strategic, calculated deal-making.

Explore Opportunities with Eurogroup Consulting M&A Asia

For investors and businesses looking to navigate this fast-moving environment, expert guidance is essential. Eurogroup Consulting M&A Asia, a global consulting firm, helps clients assess opportunities, build strategic partnerships, and capture value in the evolving Asian M&A ecosystem.

To explore how your business can benefit from the growing Asia M&A Private Equity Momentum, contact Eurogroup Consulting M&A Asia today and discover solutions tailored to your goals.

FAQs

1. What is driving Asia’s private equity momentum in 2025?

Rising deal confidence, strong tech and infrastructure focus, and steady capital flows are key drivers.

2. Which sectors are attracting the most private equity investment?

Technology, financial services, healthcare, and renewable energy are leading sectors.

3. How has Southeast Asia performed in private equity activity?

It saw a 5.5x surge in deal value and 20% share of total M&A activity in Q1 2025.

4. What macro challenges affect Asia’s M&A market?

Inflation, global uncertainty, and slower growth still pose challenges, but the pipeline remains resilient.

5. How can Eurogroup Consulting M&A Asia help in M&A strategy?

They offer global expertise to guide investors through complex transactions and identify growth opportunities in Asia M&A Private Equity Momentum.