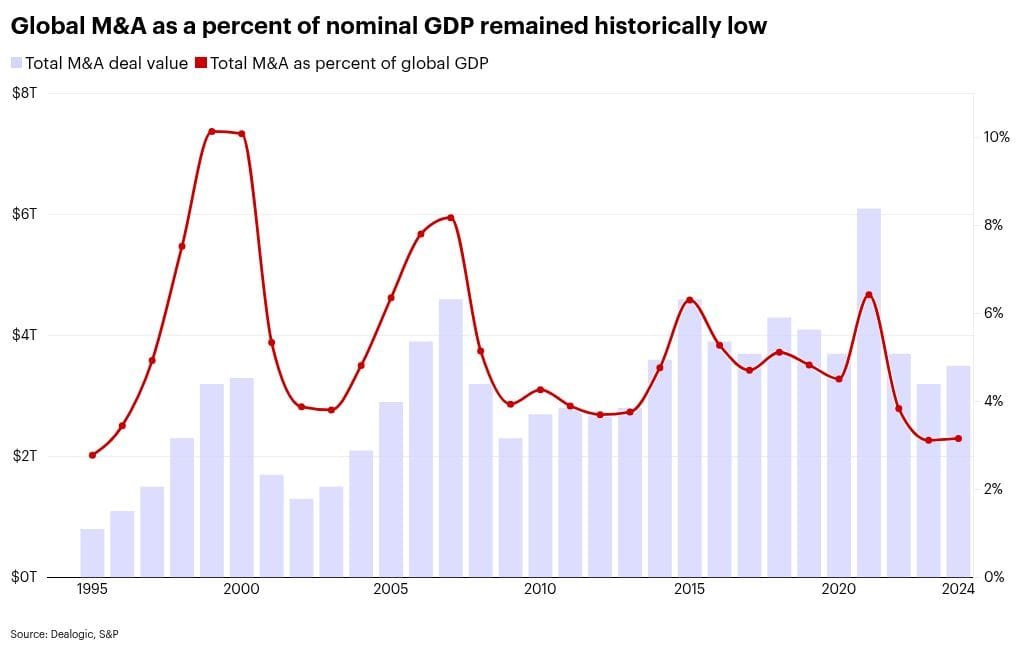

The global mergers and acquisitions (M&A) market is building momentum in 2025. Despite geopolitical risks and regional challenges, deal values are climbing at a rapid pace. With Asia rebounding strongly and the U.S. providing favorable conditions, the Asia M&A $4T Market Forecast is shaping into reality.

Asia M&A $4T Market Forecast: The Remarkable Rebound

Asia has emerged as one of the most dynamic regions for M&A activity in 2025. In just the first half of the year, deal value soared to $650 billion, more than double the amount recorded in the same period last year.

Japan led the surge with a record-breaking $232 billion in deals, many involving large privatizations. India and Southeast Asia also contributed significantly, supported by rising domestic investment and a push for financial sector growth.

This Asia M&A $4T Market Forecast rebound comes despite a 43% decline in Asia-Pacific deal activity earlier in the year caused by political and local challenges. With Asia’s overall economic growth forecast at 4.5% to 4.9% for 2025, the environment remains supportive of continued dealmaking, though the pace may moderate compared to last year.

Read Also: Hopeful Signs as Asia M&A Activity Outlook Defies Headwinds

Global M&A Surges Toward $4 Trillion

Globally, M&A deal value reached $1.1 trillion in the first half of 2025.

While total volumes fell by 9% compared to 2024, deal values rose by 15%. The rise reflects a clear trend toward larger transactions.

Deals above $1 billion increased by 19%.

Mega-deals above $5 billion rose by 16%.

North America dominated the global landscape, generating $685 billion, or 62% of worldwide M&A activity. The Americas as a whole recorded $908 billion, a 16% increase from the prior year. This surge highlights how domestic confidence, capital availability, and strategic growth initiatives are fueling bigger plays.

With this trajectory, analysts expect the global M&A market to surpass $4 trillion in 2025, cementing its role as a driver of corporate transformation.

The U.S. as a Key Catalyst

The U.S. has been pivotal in fueling optimism for the year ahead. More than half of midsize company executives surveyed in 2025 expect a strong M&A market. 59% pointed to economic growth and easing inflation as the main drivers, while others highlighted the likelihood of interest rate cuts and a more favorable regulatory environment following the U.S. election.

The U.S. stock market’s performance in 2024 also set the stage for an M&A boom. The S&P 500 rose 23%, marking 57 record closes. High valuations encouraged dealmaking, supported by corporations holding around $7.5 trillion in cash reserves for acquisitions.

Despite ongoing challenges like tariffs and global policy tensions, U.S.-led M&A volumes in the Americas increased 23% in early 2025, reinforcing bullish projections for the remainder of the year.

Why Momentum Matters for Asia M&A $4T Market Forecast

The combination of Asia’s rebound, rising U.S. confidence, and stronger valuations has created one of the most favorable M&A landscapes in recent memory. Investors are signaling trust in long-term growth while corporations are seizing opportunities to scale, diversify, and strengthen market positions.

The Asia M&A $4T Market Forecast is not just about numbers. It reflects global confidence that economic growth, capital strength, and regulatory clarity can offset short-term headwinds. For both global players and regional firms, 2025 is shaping up to be a defining year in corporate dealmaking.

FAQs

1. What is driving Asia’s M&A growth in 2025?

Strong deals in Japan, India, and Southeast Asia, especially in finance and privatization.

2. How much is the global M&A market expected to reach in 2025?

Over $4 trillion in deal value, fueled by rising mega-deals and U.S. momentum.

3. Why are U.S. conditions important for global M&A?

Economic growth, easing inflation, and strong corporate cash reserves encourage more deals.

4. What sectors are seeing the most activity?

Financial services, large privatizations in Japan, and corporate consolidations.

5. How is the trend different from last year?

Fewer overall deals but much larger in value, reflecting strategic mega-transactions.