The Asia M&A Technology Focus spans both established economies and emerging markets. China, Japan, and India remain at the center of deal activity, while Vietnam, Indonesia, the Philippines, and Malaysia are emerging as the next growth engines. These countries are drawing attention as first-mover opportunities where digital adoption, fintech expansion, and AI-driven solutions are accelerating.

Getting to Know Asia M&A Technology Focus and Landscape

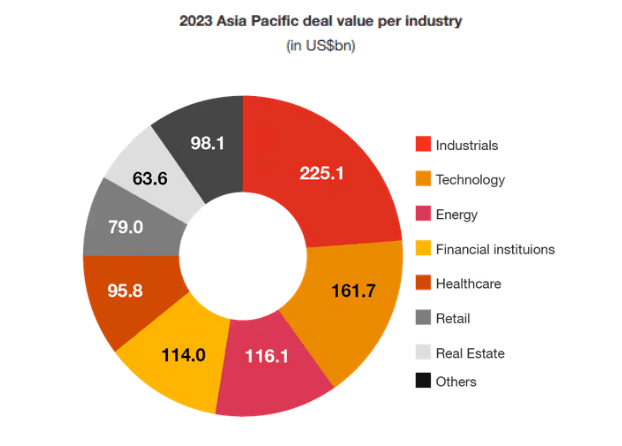

Asia’s M&A landscape is charging into the second half of 2025 with one clear theme — technology and renewables are leading the way. Despite global economic pressure and political uncertainty, Asia-Pacific continues to attract investors with its digital transformation drive and ambitious clean energy goals.

By the end of the first half of 2025, mergers and acquisitions linked to digital transformation across the region reached US$92.4 billion across 1,195 deals. That’s a 113% jump in value compared to the previous year, even as deal volume slipped by 9%. By September 2025, the value had already hit US$111.7 billion, surpassing the US$77.2 billion recorded in the same period of 2024. The numbers make one thing clear — Asia’s tech-driven dealmaking is not slowing down.

Read Also: Asia M&A Cross-Border Digitization is Driven by Digital Infrastructure Needs

Globally, technology M&A fell by 11% in the first half of 2025, hurt by inflation and geopolitics. Yet Asia stood out. Investors are continuing to bet on the region’s digital future, driven by deep structural strengths — from fast-growing populations and urbanization to strong government support for innovation.

Renewables Take the Spotlight in H2 2025

While technology dominates headlines, renewable energy is matching its momentum. Southeast Asia’s clean energy ambitions are gaining traction. Cambodia aims for 70% renewables by 2030, while the Philippines now allows 100% foreign ownership in renewable projects.

Across the continent, renewable energy is expected to provide 23% to 26% of Asia’s electricity in 2025. Investment is flowing into large and complex projects, including offshore wind farms in Japan and Vietnam. These efforts are backed by government incentives and climate policies pushing for a lower-carbon future.

Private equity and strategic investors are competing fiercely for renewable assets. The growing appetite reflects strong confidence in long-term returns from Asia’s green transition. Energy transition projects — including hydrogen, carbon capture, and sustainable aviation fuels — are increasingly shaping M&A pipelines.

Asia M&A Technology Focus: Projections Point to Long-Term Growth

Experts believe both digital transformation and renewables will remain the twin engines of Asia’s deal activity in the years ahead. These sectors benefit from the region’s demographics, urbanization, and government-led digital and green economy programs.

At the same time, Asia’s commitment to the Paris Agreement goals — including a 45% cut in emissions by 2030 and net zero by 2050 — is reinforcing investor interest in sustainable infrastructure. As regulation becomes clearer and cross-border investment rules loosen, foreign and regional investors alike see lasting opportunity.

Read Also: Asia Infrastructure M&A Fundraising Surges with $4B

Emerging markets are particularly attractive for Asia M&A Technology Focus. They combine strong demand for digital services with ambitious clean energy plans — a combination few other regions can match. This blend of growth, openness, and innovation is reshaping Asia’s M&A profile.

Asia M&A Technology Focus: What’s Next?

Despite global headwinds, Asia’s M&A story in 2025 is one of strength and adaptation. The region is proving that even in uncertain times, transformation pays off. Technology continues to set the pace, and renewables are now firmly part of the same growth narrative.

As Asia heads into the second half of 2025, the Asia M&A Technology Focus reflects not just a regional trend but a global shift — where innovation and sustainability together define the next frontier of dealmaking.