In Asia, mergers and acquisitions (M&A) are becoming more complex. Cross-border deals, new regulations, and volatile markets are pushing companies to find ways to manage risk. As a result, Asia M&A Insurance Trends show strong growth, with buyers and sellers relying more on insurance to protect transactions.

Asia M&A Insurance Trends: A Region Leading Global Insurance Uptake

South and Southeast Asia are at the forefront of this shift. In 2025, 45% of respondents in the region expect higher use of deal insurance such as representations and warranties (R&W) coverage. This is one of the strongest growth projections worldwide.

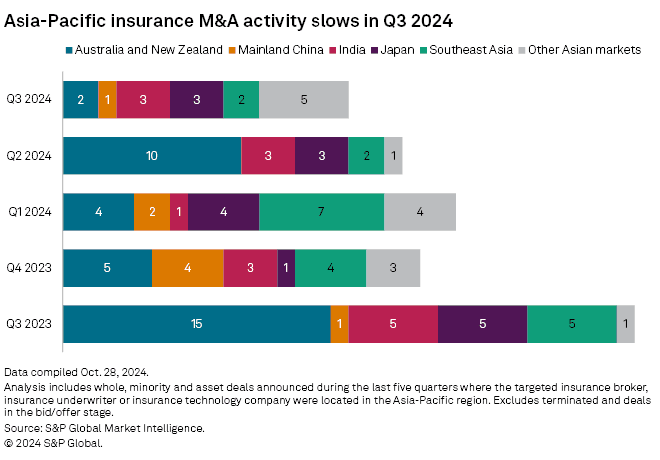

The trend is already visible in the numbers. In 2024, Asia recorded the highest number of insurance-related M&A deals globally, rising 13% from 2023. While overall deal values fell by 47%, the rising adoption of insurance highlights how companies are focusing more on risk management than deal size alone.

Why Insurance Is Becoming Essential

Several forces explain the rise of M&A insurance in Asia. Private equity investors are highly active, often working under strict timelines and needing certainty at closing. Regulatory scrutiny across Asian markets is also increasing, with new compliance standards adding more layers of complexity to transactions.

Trade tensions and shifting market conditions further add to deal risks. Insurance has become a practical solution to de-risk deals and keep them moving forward. Sellers now often require insurance as a condition to close, reflecting how vital these tools have become.

Complex Deals, Higher Demand in Asia M&A Insurance Trends

Cross-border deals are a major driver of insurance use. Buyers entering new Asian markets face unfamiliar rules, varying compliance standards, and operational risks. Insurance allows them to proceed with confidence while protecting against hidden liabilities.

The steady rise in W&I insurance claims in Asia also points to increasing adoption. Companies are not only buying these policies but also actively using them. Timely claims show that insured parties now understand the value of protection, making insurance a normal part of deal strategy.

Read Also: Why M&A Insurance Uptake Rises Across Asian Markets

The Role of Strategic Insurers

Strategic insurers see Asia as a growth engine. In 2025, they expect an active M&A market across the region, with insurance becoming a core part of deal structuring. Insurers are scaling up to meet demand, offering tailored products that reflect the realities of Asian transactions.

This aligns with broader market trends. The Asia-Pacific region, alongside Europe, is leading global M&A activity. Buyers in the region are outperforming indexes by 3.9 percentage points, demonstrating resilience and strategic advantage. Insurance is helping sustain that edge by reducing deal risks.

Impact of Regulation and Market Consolidation

Another factor driving demand is regulation within Asia’s own insurance markets. Stricter capital requirements and consolidation are reshaping the sector. Volatility in these local markets pushes both investors and insurers to rely more on structured insurance solutions during M&A.

This regulatory backdrop means insurance is not just about protecting deals—it is also about adapting to the financial and compliance changes sweeping across the region.

Read Also: How Asia M&A Regulatory Changes Shift the Game

Asia M&A Insurance Trends: Looking Ahead

The direction is clear: M&A in Asia will continue to grow more complex, and insurance will play an even larger role. With nearly half of South and Southeast Asian dealmakers expecting increased uptake, Asia M&A Insurance Trends suggest the region is setting the pace for global adoption. For both buyers and sellers, insurance is no longer optional. It is becoming a standard tool to navigate risk, meet regulatory demands, and close deals with confidence.

FAQs

1. What is M&A insurance?

It protects buyers and sellers in mergers and acquisitions from financial losses due to unknown risks or breaches of warranties.

2. Why is M&A insurance growing in Asia?

Complex deals, strict regulations, and cross-border risks are driving adoption across the region.

3. What types of M&A insurance are common?

Representations and warranties (R&W) insurance is the most widely used.

4. How much growth is expected in Asia?

About 45% of dealmakers in South and Southeast Asia expect higher insurance uptake in 2025.

5. Do sellers benefit from M&A insurance?

Yes. Sellers use it to limit liability and close deals faster with fewer disputes.