The mergers and acquisitions (M&A) market is becoming more complex. Global dealmaking rebounded in 2024, reaching $3.4 trillion in transactions, an 8% increase from the previous year. Alongside this rebound, the demand for M&A insurance solutions has surged, helping buyers and sellers navigate growing risks. Let’s discuss M&A Insurance Uptake Rises further!

M&A Insurance Uptake Rises: A Market on the Rise

Transactional risk insurance, including representations and warranties (R&W) insurance, is now an essential tool for dealmakers. From 2023 to 2024, the median transaction value insured rose by 18%, and more than 50 deals exceeding $1 billion were covered. This shows not only a rise in deal volume but also a willingness to insure larger and more complex transactions.

The growing adoption is further evidenced by rising claims. In 2024, there were 309 R&W claims, up 21% from the prior year, highlighting how parties increasingly rely on insurance to safeguard against breaches and unforeseen risks.

Asia’s Momentum in M&A Insurance

The trend is especially strong in Asia. A recent survey found that 45% of respondents in South and Southeast Asia expect more use of deal insurance like R&W insurance in 2025. This represents one of the highest projected increases globally.

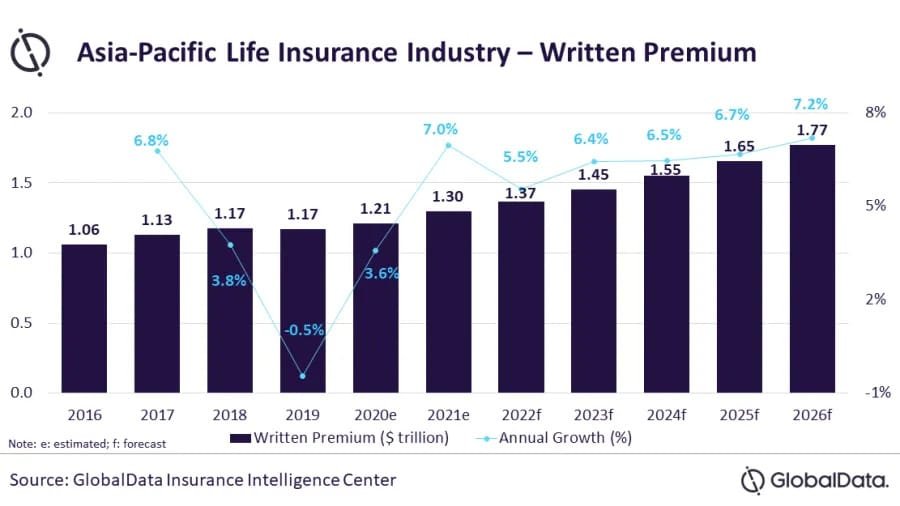

In the Asia-Pacific region, both the number and value of deals expanded in 2024. Private equity firms, strategic buyers, and even government-linked entities are adopting M&A insurance as part of their deal structures. This marks a clear shift from insurance being optional to becoming a standard feature in high-value cross-border transactions.

Drivers of Adoption: Complexity and Regulation

A key factor behind this surge is the increased complexity of cross-border transactions. Companies navigating different jurisdictions face unfamiliar legal systems and regulatory requirements. M&A insurance provides a buffer, protecting buyers and sellers against liabilities that may surface post-transaction.

At the same time, regulatory scrutiny is intensifying. Antitrust reviews, foreign investment rules, and financial compliance checks all add layers of uncertainty. In this environment, insurance becomes a valuable tool for managing regulatory and contractual risks.

Asia and The Evolving M&A Insurance Uptake Rises

The Asian M&A insurance market is also diversifying beyond R&W insurance. New insurers are entering with specialized products such as contingent risk insurance and cyber insurance. These offerings address exposures like pending litigation, tax liabilities, or cyber vulnerabilities that can threaten deal certainty.

This expansion reflects how dealmakers in Asia are aligning with global best practices, where a broad range of risk-transfer products supports smoother negotiations and quicker deal closures.

Harmonization and Market Reforms

Asia is also seeing regulatory reforms that encourage consolidation within the insurance sector itself. Larger insurers can achieve better compliance and scale, improving the availability of M&A insurance.

Another development is the harmonization of policy terms, inspired by London market practices. This makes M&A insurance policies more transparent and standardized across borders, boosting confidence among international investors.

Read Also: How Southeast Asia M&A Digital Transformation Fueled by New Tech

M&A Insurance Uptake Rises: A Structural Shift in Deal-Making

The rise in M&A insurance is more than just a trend. It represents a structural shift in how deals are executed in Asia. By reducing uncertainty, insurance improves trust between buyers and sellers. It also facilitates faster deal completion, an important advantage in competitive bidding situations.

As M&A Insurance Uptake Rises, Asia is positioning itself at the forefront of global dealmaking innovation. The region’s embrace of insurance solutions highlights its adaptability to growing complexities and its ambition to align with global standards.