The mergers and acquisitions (M&A) landscape in Asia is undergoing a sharp transformation. Private equity is now driving much of the momentum, reshaping industries, and setting new benchmarks for deal-making. Recent numbers reveal a powerful trend in Asia M&A Private Equity Momentum that reflects growing investor appetite. It also shows a shift toward longer-term, asset-backed strategies.

Asia M&A Private Equity Momentum and Values Surge

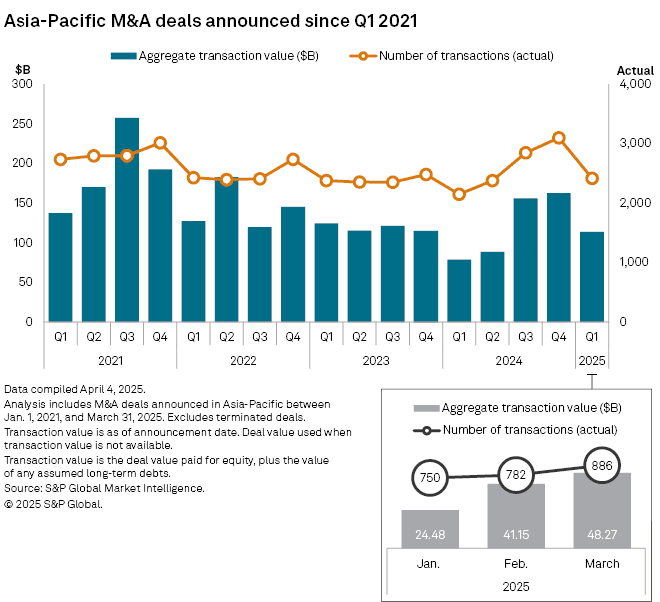

In the first quarter of 2025, Asia-Pacific M&A deal values reached $113.8 billion across 2,416 new deals. This marked a 44% increase in value and a 12% increase in deal count compared to the same period in 2024.

Much of this growth was powered by private equity. PE buyout deal values more than doubled, soaring from $26.8 billion in Q1 2024 to $57.6 billion in Q1 2025. This surge confirms that private equity firms are not only active but increasingly dominant in the region’s deal-making environment.

Private Equity’s Expanding Role

The Asia-Pacific private equity deal value for 2024 hit $175.8 billion, a 19% jump from 2023, and the strongest performance since 2021. Private equity investors are showing greater confidence in the region, targeting both growth opportunities and restructuring needs.

Globally, private equity-led transaction values in the first half of 2025 rose 33% to $471 billion. Asia has been a major contributor to this acceleration, highlighting the region’s rising importance to global PE portfolios.

Southeast Asia Stands Out in Asia M&A Private Equity Momentum

One of the most striking developments comes from Southeast Asia. In Q1 2025, M&A deal value surged 296.1% quarter-on-quarter. Private equity accounted for nearly 93% of startup M&A deal value, underscoring its role as the primary growth driver.

Sectors such as infrastructure, renewables, and logistics are attracting PE-backed investments. These long-duration, asset-heavy plays reflect a pivot away from quick exits toward sustainable value creation. This signals confidence in the long-term economic fundamentals of the region.

Read Also: See Why Investor Confidence Grows in Asia M&A Trends 2025

EQT’s Fujitec Deal: A Flagship Transaction

Nothing illustrates the Asia M&A Private Equity Momentum better than EQT’s bold move in Japan. In 2025, the Swedish private equity firm announced a $2.7 billion tender offer to acquire an 85% stake in Fujitec, a major player in elevator and escalator technology.

This deal marks one of the largest PE-led buyouts in Asian tech this year. It highlights how private equity firms are willing to pursue transformative deals that reshape established industries.

EQT’s presence in Asia has been growing steadily. Since 2019, it has expanded Nexon Asia through eight acquisitions, showing a clear strategy of building scale and driving consolidation. The Fujitec acquisition adds weight to its position as a serious long-term player in the region.

Why This Matters for Asia’s Business Landscape

The rise in private equity-backed deals signals more than just financial strength. It indicates a deeper structural shift in how capital is deployed across Asia.

Private equity brings not only funding but also expertise, operational efficiency, and global networks. For sectors like renewables and logistics, this means faster modernization and broader international integration. For startups, it means stronger support to scale beyond borders.

At the same time, the reliance on private equity capital highlights potential risks. Valuations could face pressure if global financial conditions tighten. However, the current wave suggests that private equity sees Asia as central to its long-term strategy.

Read Also: Asia-Pacific M&A Market Analysis and What Investors Must Know

The Outlook: Asia M&A Private Equity Momentum

From record-breaking buyouts to surging regional deal values, Asia is experiencing a new era of M&A led by private equity. With firms like EQT setting examples through billion-dollar acquisitions, the Asia M&A Private Equity Momentum shows no signs of slowing. As the region continues to attract large pools of global capital, businesses can expect more restructuring, consolidation, and innovation driven by private equity. This wave is reshaping industries and may define the next decade of growth across Asia.

FAQs

1. What is driving Asia M&A growth in 2025?

Rising private equity activity, with buyout values doubling year-on-year.

2. Which region in Asia showed the strongest surge?

Southeast Asia, where M&A deal values rose 296.1% in Q1 2025.

3. What is the significance of EQT’s Fujitec acquisition?

It marks a $2.7 billion PE-led buyout in Japan, showcasing the scale of deals now happening in Asia.

4. Which sectors are attracting private equity most?

Infrastructure, renewables, logistics, and technology are top areas.

5. How much did private equity deals rise globally in 2025?

They increased by 33% in the first half of the year, reaching $471 billion.Asia M&A Private Equity Momentum