The first half of 2025 has shown how strong Asia-Pacific’s dealmaking landscape can be, even as global markets face slowdowns. While many regions saw sharp contractions, Asia-Pacific delivered growth in both deal value and transaction sophistication. This Asia Pacific M&A Resilience highlights why investors continue to turn to the region despite global headwinds.

Record Surge in Deal Value Proofs Asia Pacific M&A Resilience

Asia-Pacific’s M&A market posted a striking 90% surge in total deal value in H1 2025, a remarkable outcome given the broader global slump. Investor appetite was supported by high-value strategic acquisitions and demand for assets in sectors like technology, infrastructure, and energy.

Even though overall deal activity slipped 2% year-over-year from January to May 2025, this minor dip stands in stark contrast to declines in other regions: Latin America dropped 12% while the Middle East and Africa fell 9%. The numbers confirm Asia-Pacific as a resilient and attractive investment destination.

Rising Deal Volumes and Completed Transactions

The region also posted growth in deal counts. Asia-Pacific deal volume rose 3% in H1 2025 compared to the same period in 2024, while the number of completed deals jumped from 69 to 100. This sharp rise signals stronger execution rates and renewed confidence in closing transactions.

For investors, more completed deals mean reduced uncertainty, healthier pipelines, and greater liquidity across markets.

Asia Pacific M&A Resilience and The Regional Growth Hotspots

Two markets stood out as engines of deal activity:

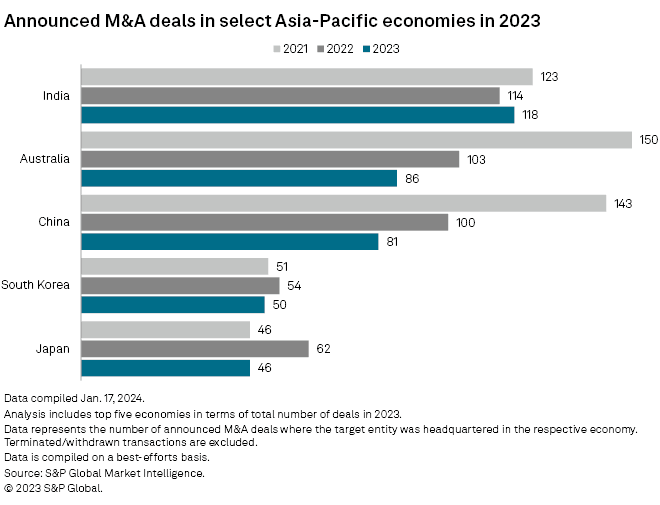

Japan recorded a 25% increase in M&A volumes, driven by corporate restructuring and outbound interest.

India delivered a 12% increase, supported by strong domestic demand, rising corporate consolidations, and sector reforms.

Meanwhile, Southeast Asia delivered impressive scale. Average deal size in the region rose 22% year-over-year to US$133 million, while Q1 2025 deal value skyrocketed 296% quarter-on-quarter, fueled largely by Indonesian state-owned enterprise restructurings.

These figures show that Asia-Pacific’s resilience is not uniform but anchored in regional diversity, where each market offers distinct growth dynamics.

Superior Returns for APAC Buyers

One of the strongest signs of confidence came from deal performance. Buyers in Asia-Pacific outperformed their market index by 3.9 percentage points on transactions worth over US$100 million in H1 2025. This suggests not only strong deal flow but also smarter execution and better post-merger integration than peers in other regions.

For global investors weighing where to allocate capital, these returns stand out as proof of the region’s M&A strength.

Maturing Transactions and Risk Management

The growth in M&A insurance adoption across Asia-Pacific highlights a more sophisticated market environment. Insurance tools are now common in complex, cross-border transactions, offering buyers and sellers greater protection. India led in claims notifications, followed by Greater China and Korea, showing where risk management practices are most active.

This increasing reliance on insurance signals that APAC deals are not just growing in size, but also in complexity and maturity.

Asia Pacific M&A Resilience: The Region Leads Amid Global Uncertainty

With Europe as the only other region showing positive deal momentum, Asia-Pacific has cemented itself as a leader in global M&A activity. Investors continue to place confidence in its diverse economies, scalable opportunities, and ability to weather external shocks.

From Japan’s restructuring to Southeast Asia’s mega deals, the story of Asia Pacific M&A Resilience is one of adaptability and growth. While the global downturn has stalled dealmaking elsewhere, Asia-Pacific continues to build momentum and set the pace for the future of M&A.

Read Also: Hopeful Signs as Asia M&A Activity Outlook Defies Headwinds